Part 2 of our ETF series: Today we’re talking about whether it makes sense for you to invest in ETFs and how much return ETFs can bring you compared to your savings accounts.

You know that you finally want to start building your wealth, but you’re just not sure what’s right for you?

An ETF makes sense for you especially if…

- You’re not currently paying off a property and don’t plan to buy one. Real estate is an investment in itself, requiring a lot of money and time. Both often become too much.

- You have excess income that you don’t need now or for the foreseeable future. Important: In addition, you should always have an emergency fund of three to six net monthly salaries, e.g., in a savings account.

- Your state pension in old age will probably not be enough to maintain your standard of living. This will apply to most of us, partly due to inflation.

- You have at least 15 to 20 years until retirement. The number one savings goal of ETFs is usually retirement planning.

Of course there are other options for retirement planning. But they are often expensive, too risky and/or do not offer sufficient returns. The latter applies, for example, to call money and fixed-term deposits. Although interest rates are currently rising, interest rates here are currently in the range of 1 to 3% pa. That is by no means enough for retirement planning.

Private pension and life insurance policies are also not promising. They usually have high fees and cannot guarantee you a high increase in value. Subsidized retirement plans such as Riester, Rürup or company pension plans can be worthwhile, but usually only a small component of your retirement planning.

ETFs cost little and deliver a lot.

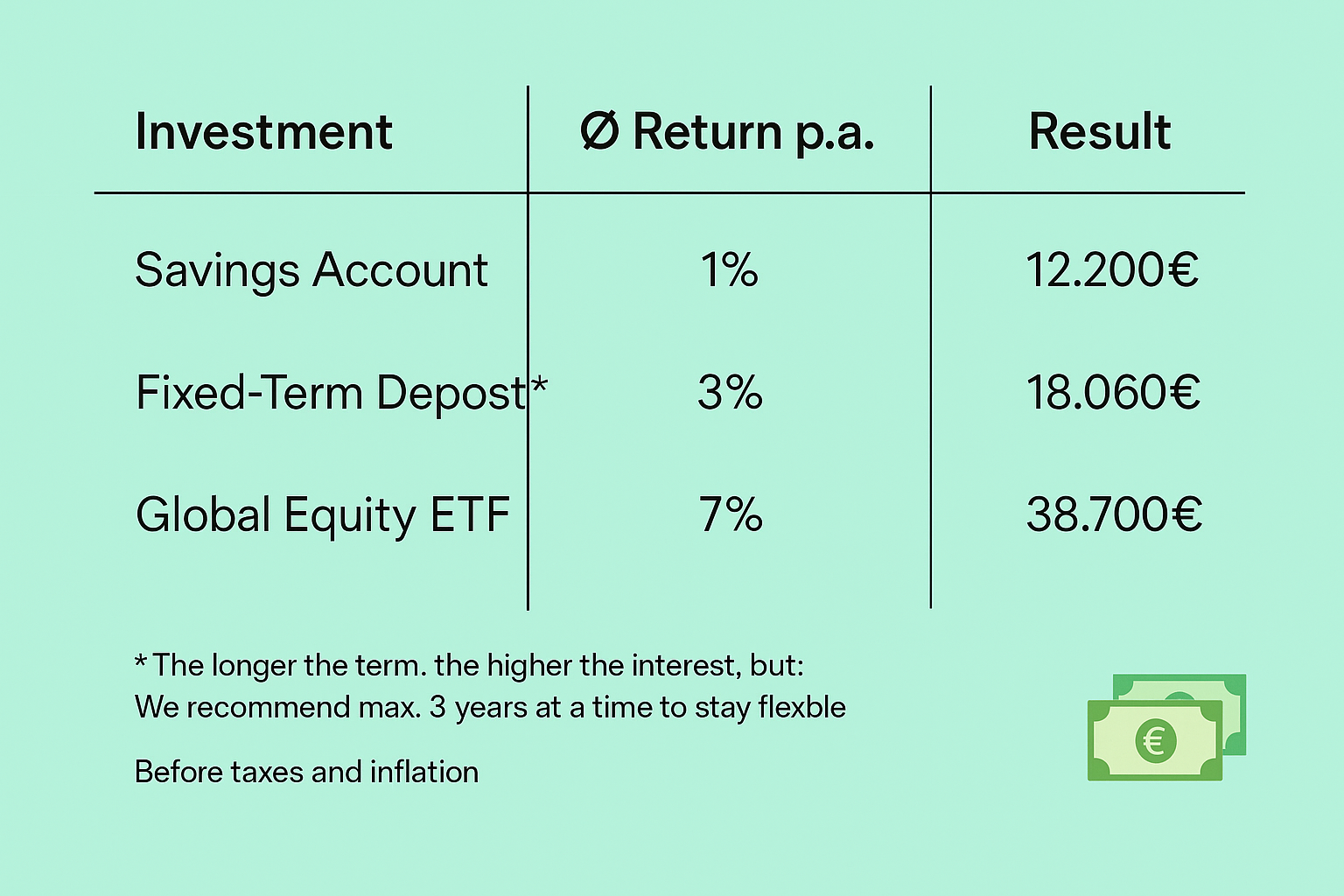

ETFs cost you almost no fees, and you can expect an average annual return of 7% over 15 years—through better times and worse. That’s significantly more than any fixed-term deposit account offers. Here’s a small example of what happens to €10,000 if you invest it for 20 years in a call money or fixed-term deposit account, compared to a global equity ETF:

While interest rates on call money accounts are currently higher, the account is still not suitable for your long-term investment. ETFs, on the other hand, offer a good opportunity for you to stay above the historical average inflation rate of 2% per year and build long-term wealth. They’re not only sensible, they’re necessary if you want to maintain your standard of living in old age.

Missed the first part of our ETF series? Click here:

And here you’ll find: